Loan Programs

Our Loan Programs

We’ve got you covered! With our extensive network of lending partners, we provide a range of loan programs tailored to fit your needs, whether it’s for residential or commercial properties. Our rates are competitive, and you can rest easy knowing that you are supported by a seasoned and experienced team of experts in the industry.

Loan Programs for

Typical Homebuyers

Conventional Loans

Low to Moderate Income Programs

High Balance/Jumbo Loans

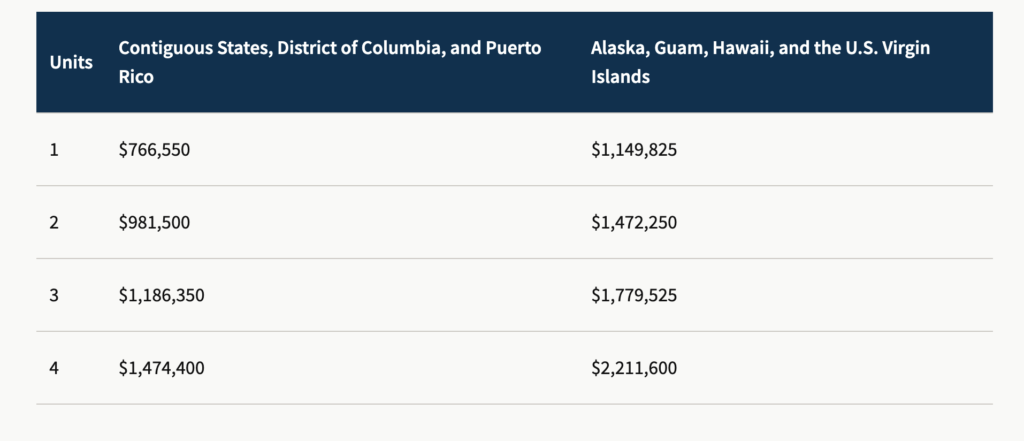

Conventional Loans

Conforming loans form the backbone of the mortgage market; they follow a standardized underwriting and approval process, providng clarity and consistency for borrowers. Their limits vary by location and change annually. They are purchased by Fannie Mae and Freddie Mac. The 2024 conforming limits are as below:

Interest Rate

They typically come with lower interest rates compared to non-conforming options, translating to lower monthly payments and savings over the life of the loan.

Eligibility Requirement

- Credit Score: While specific requirements may vary lender by lender, a min credit score of around 620 is typically needed to qualify for a conforming loan.

- Down Payment: The minimum down payment required for a conventional mortgage is 3%, but borrowers with lower credit or higher DTI ratios may be required to put down more. For most people, the minimum down payment is 5%. Expect to pay a private mortgage insurance (PMI) if your down payment is less than 20%.

- Stable Income and Employment – full documentation of income, assets, and other financial information are needed.

Low to Moderate Income Loan

These programs are for people who make less than 80% of AMI. They have reduced interest rates and mortgage insurance. Borrowers need to complete a homeownership education course to be eligible. These programs aim to provide affordable financing options to help more people achieve homeownership who may not qualify for conventional financing otherwise.

High Balance and Jumbo Loans

These loans are for loans exceeding the standard conforming loan limits. Borrower need to make larger down payments. Lenders may require a minimum of 10% for high balance loans and 20% for jumbo loans.

The underwriting guidelines are also stricter, and the debt-to-income (DTI) ratio is lower to qualify for these loans.

Loan Programs for

First-Time Homebuyers

First Time Homebuyer Programs

Down Payment Assistance (DPA) Program

First Time Homebuyer Programs

Down payment can be as low as 3%. A homeownership education course is required to be eligible. There are no income limits. Minimum 620 credit score. Better interest rates.

Down Payment Assistance (DPA) Program

These programs are initiatives aimed at helping homebuyers overcome the hurdle of coming up with a down payment when purchasing a home. They are often sponsored by state or local government agencies, nonprofit organizations, or even private entities.

DPA programs provide financial assistance to eligible homebuyers in the form of grants, loans, or forgivable loans for down payment and or closing costs associated with purchasing a home. Common eligibility factors include income limits, credit score requirement, and completion of a homebuyer education course.

The home purchased must be the homebuyer’s primary residence. Some DPA programs have limited funding and assistance may be provided on a first-come, first-served basis or subject to certain priority criteria, such as targeting assistance to spefici geographic areas or underserved populations.

Loan Programs for

Credit Challenged Borrowers

FHA Loans

Credit Upgrade Services

FHA Loans

FHA loans allow for lower down payment, as low as 3.5%, and more lenient credit score, as low as 580, requirement compared to conventional loans. FHA loans require borrowers to pay an upfront mortgage insurance premium (UFMIP) at closing and an annual mortgage insurance premium (MIP) paid monthly as part of the mortgage payment. Their interest rates are usually lower than conventional mortgage. Their underwriting guidelines, sometimes, are stricter than conventional mortgage, but more lenient on credit requirements.

Credit Upgrade Services

It is part of our concierge services that we can review our client’s credit profile and develop a plan to work with you to improve your credit score. We can also help you quickly establish a credit if you don’t have a credit score yet.

Loan Programs for

Homeowners in Rural Areas

USDA Loans

USDA Loans

USDA programs aim to promote homeownership and economic development in rural areas by providing affordable mortgage financing options. The program requires no down payment and offers competitive interest rates and reduced mortgage insurance premiums when compared to conventional loans.

Loan Programs for

Veterans

VA Loans

VA Loans

These are mortgage loans guaranteed by the US Department of Veterans Affairs (VA) and are designed to help active-duty service members, veterans, and eligible surviving spouses achieve homeownership. Borrowers must obtain a Certificate of Eligibility (COE) from the VA to prove their eligibility for the loan. The COE verifies the borrower’s military service history and determines their entitlement amount. No down payment, and no private mortgage insurance are required. It also offers competitive interest rates when compared to conventional loans.

Loan Programs for

Self-Employed/ Business Owners

Self-Employed/ Business Owners Programs

Self-Employed/ Business Owners Programs

For self-employed or business owners with non-traditional income (e.g. no W2s) we have alternative documentation programs to help you qualify for loans. We can do loans using bank statements, P&L, 1099, WVOE, etc.

Loan Programs for

Investors/ Foreign Nationals

Investors Programs

Investors Programs

This type of loan looks mostly at the collateral and does not require income documentations from the borrowers. Investors can have easy access to financing to build their investment portfolios as long as the investment property is projected to make some income to cover some of its liabilities. We can also put foreign investors on this program.

Loan Programs for

Renovations, Fix & Flips and Constructions

Renovation Loans

Construction Loans

Renovation Loans

This loan program allows borrowers to finance the purchase or refinance of a home and include funds for renovations or improvements in the same mortgage loan with competitive interest rates. It can be used to fund a wide range of renovation projects, including structural repairs, cosmetic upgrades, room additions, and energy efficiency improvements, etc. The renovations often need to be completed by licensed contractors and the lenders may require a qualified inspector to oversee the renovation process to ensure that the work meets certain standards.

Construction Loans

Construction loans are specialized types of loans designed to finance the construction of a new home or significant renovations to an existing property. Unlike traditional mortgages, where the borrower receives the entire loan amount upfront, construction loans provide funds in stages as the construction progresses. They typically have two main phases:

- Construction Phase – During this phase, the borrower receives funds in stages, known as “draws” to cover the costs of construction or renovation. Draws are typically disbursed directly to the contractor or subcontractors based on the completion of specific construction milestones. Throughout this phase, lenders typically conduct inspections to verify that the work is progressing as planned. After each inspection, the lender releases funds for the next stage of construction based on the draw schedule outlined in the loan agreement.

- Permanent Phase – Once construction is complete, the construction loan is usually converted into a traditional mortgage, known as the permanent loan. This phase allows the borrower to repay the construction loan with a long-term mortgage that covers the final cost of the property.

Interest rates for construction loans are typically higher than those for traditional mortgages because they pose a higher risk to lenders. The construction phase has shorter terms, usually ranging from 6 months to 2 years.

Lenders typically require detailed construction plans and a comprehensive budget before approving a construction loan. This helps ensure that the loan amount is sufficient to complete the project and that the property will have adequate value upon completion.

Borrowers may be required to work with approved builders or contractors who have experience with construction loans. Lenders may also require documentation, such as licenses, insurance, etc. From the builders or contractors.

Loan Programs for

Interim & Multi-Property Financing

Buy Before You Sell & Bridge Loans

Cross-Collateral Loans

Hard-Money Loans (Fix & Flips and Wholesaling)

Buy Before You Sell & Bridge Loans

We have a program that allows homeowners to buy a property before they sell their current property, similar to a bridge loan, except that it has 0% interest.

A bridge loan is a short-term loan used temporarily until long-term financing can be secured. It’s often used to finance the purchase of a new home before selling an existing one. They are usually faster to approve, allowing borrowers to access funds quickly. Due to their short-term nature and high risk, bridge loans typically come with higher interest rates compared to traditional mortgages. They offer flexible repayment options, such as interest-only payments during the term of the loan, followed by a balloon payment from the principal at the end.

Cross-Collateral Loans

This kind of loan uses multiple assets as collateral to secure a loan to allow borrowers to access larger loan amounts. This also means that if a borrower defaults on the loan, the lender can seize all the pledged assets to recover the outstanding debt.

Hard-Money Loans (Fix & Flips and Wholesaling)

Hard money loans are a type of short-term financing typically used by real estate investors who need quick access to capital. They offer rapid approval and funding compared to traditional bank loans. They come with higher interest rates and fees. This type of loans are often used for fix-and-flip projects, or purchasing distressed properties at auction, or can be used for wholesale transactions, or can be used to quickly close on investment properties when traditional financing is not available.

Loan Programs for

High Net Worth Individuals,

Seniors and Retirees

Asset Depletion Programs

Reverse Mortgage

Asset Depletion Programs

This type of loan is designed for individuals with substantial assets but limited documented income. This program allows borrowers to use liquid assets as a source of income to qualify for a mortgage.

Reverse Mortgage

A reverse mortgage is primarily designed for homeowners aged 62 or older that allows them to convert a portion of their home equity into cash without having to sell their home or make monthly mortgage payments. The loan is typically repaid when the borrower moves out of the home, sells the property, or passes away. At that time, the loan is repaid through the sale of the home. Any remaining equity belongs to the borrower or their heirs. Borrowers are required to undergo counseling with a HUD-approved counselor in order to obtain a reverse mortgage.

Reverse mortgage can provide financial flexibility for older homeowners and can be a valuable financial tool for eligible homeowners seeking to tap into home equity in retirement.

Summary of Loan Terms:

- Equity Ownership: Borrowers may lose some or all equity in the property at the loan’s end. Repayment may require selling or transferring the property or using other assets.

- Fees and Charges: Lenders may add origination fees, mortgage insurance premiums, closing costs, and servicing fees to the loan balance.

- Loan Balance Growth: The reverse mortgage loan balance grows over time, accruing interest on the outstanding amount.

- Borrower Responsibilities: Borrowers retain property title and must pay property taxes, insurance, and maintenance. Failure to do so can trigger immediate loan repayment, tax liens, or foreclosure.

- Tax Deductibility: Interest on the reverse mortgage is not tax-deductible until the loan is partially or fully repaid.

Loan Programs for

ITIN Borrowers

ITIN Loans

ITIN Loans

ITIN loans are specialized loan programs that are designed for individuals who do not have a social security number (SSN) but possess an ITIN issued by the IRS.

Loan Programs for

Medical Professionals

Doctor’s Loan

Doctor’s Loan

This is also known as a physician mortgage or physician loan. It is a specialized type of mortgage designed to meet the unique financial needs of medical professionals, including doctors, dentists, veterinarians, medical residents, physician assistants, registered nurses, nurse anesthetist, nurse practitioner, and clinical nurse specialists.

Loan Programs for

Cashout and Refinances

Refinances

Second Mortgages/Helocs

Refinances

The primary purposes of refinancing are to save money, reduce monthly payments, or cash-out equities in the property. Borrowers can use the cash-out to consolidate high-interest debt, such as credit card balances or personal loans, into a single, lower-interest mortgage payment.

Second Mortgages/Helocs

This type of mortgages are financial products that allow homeowners to borrow against the equity in their property for various purposes such as home improvements, debt consolidation, to cover major expenses such as medical bills, education costs, or unexpected emergencies, and to use it for other investment opportunities such as to get the cash out to invest in other real estate investment properties, stocks, or business opportunities.

Loan Programs for

Commercial Properties

Commercial Loans

Loans for Commercial Properties

We have commercial loans that can be used to finance the purchase of commercial properties including office buildings, retail spaces, industrial facilities, and multifamily properties, etc. We can also help with SBA loans and commercial construction loans

Tell us your story.

Whether you are a first-time homebuyer or a seasoned investor, having a reliable mortgage team is crucial to your success.

We pride ourselves on clear communication and being theire when you need us. Our expert team will walk you through every step of the way.

Ready to chat about your mortgage? Just fill out the forms on the right!

What are your goals?

We are committed to helping you reach them.

I want to purchase